Initial public offering

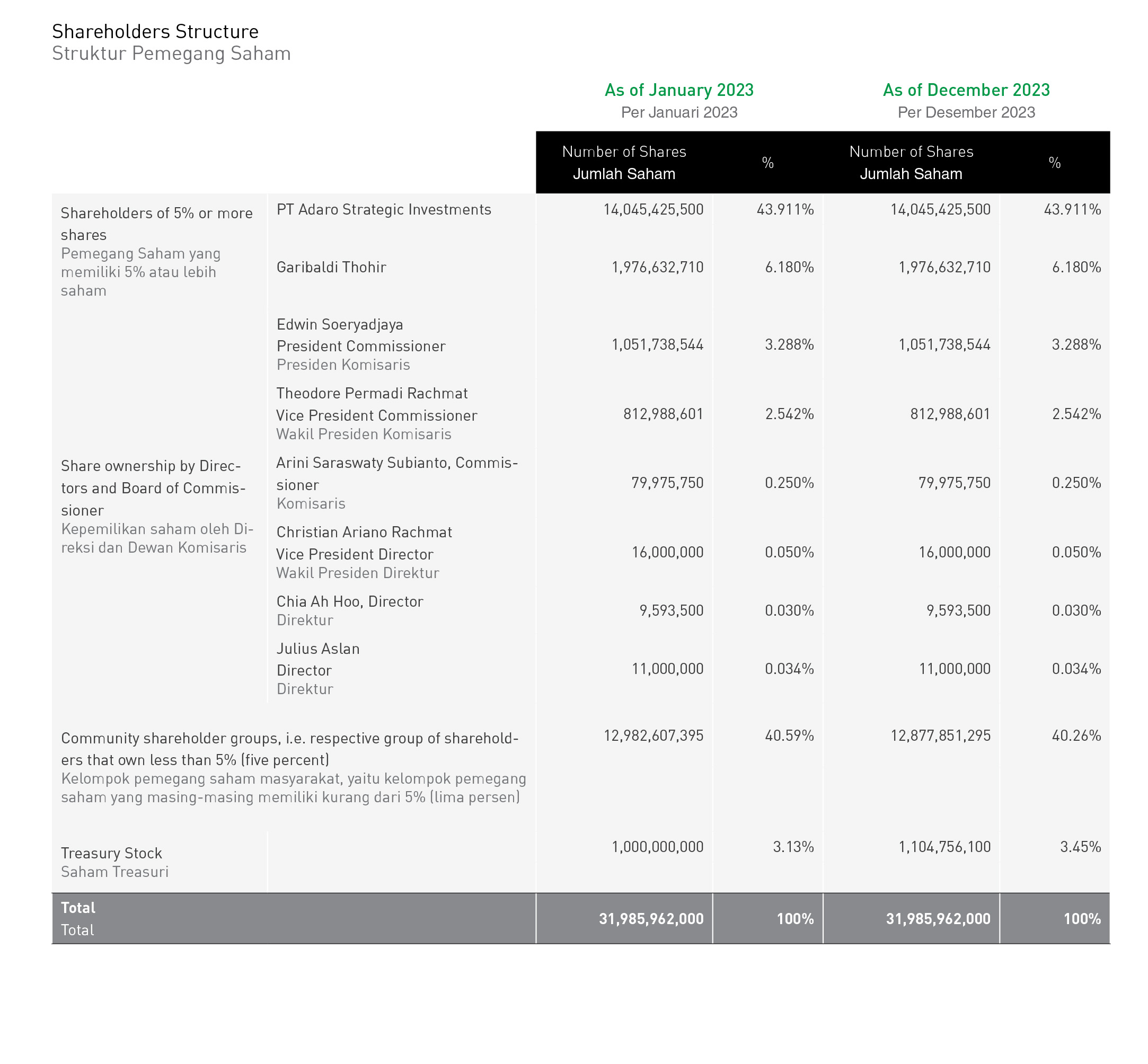

On July 16, 2008, Adaro Energy Indonesia (AEI) was officially listed on Indonesian Stock Exchange (IDX) with ticker code ADRO after completing the IPO process for 11,139,331,000 shares or 35% of the 31,985,962,000 shares issued and fully paid-up. By raising Rp12.2 trillion, this IPO is one of the largest IPOs in the IDX history. The net proceeds from the IPO were entirely spent as of May 29, 2009 and were reported to its shareholders during the AGMS on June 3, 2009.